The purpose of this treaty is to afford relief double taxation with respect to taxes on income and to prevent of tax evasion and avoidance between Cambodia and Malaysia. The Double Taxation Agreement entered into force on 8 July 1998 and was amended by a protocol signed on 22 September 2009.

Solved Taxation In Malaysia 2020 3 Provide The Objectives Chegg Com

To tackle this Double Tax Agreement DTA was established.

. Have agreed as follows. The Government of Malaysia and the Government of the Republic of Indonesia desiring to conclude an Agreement for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income have agreed as follows. 1 January 1999 for taxes.

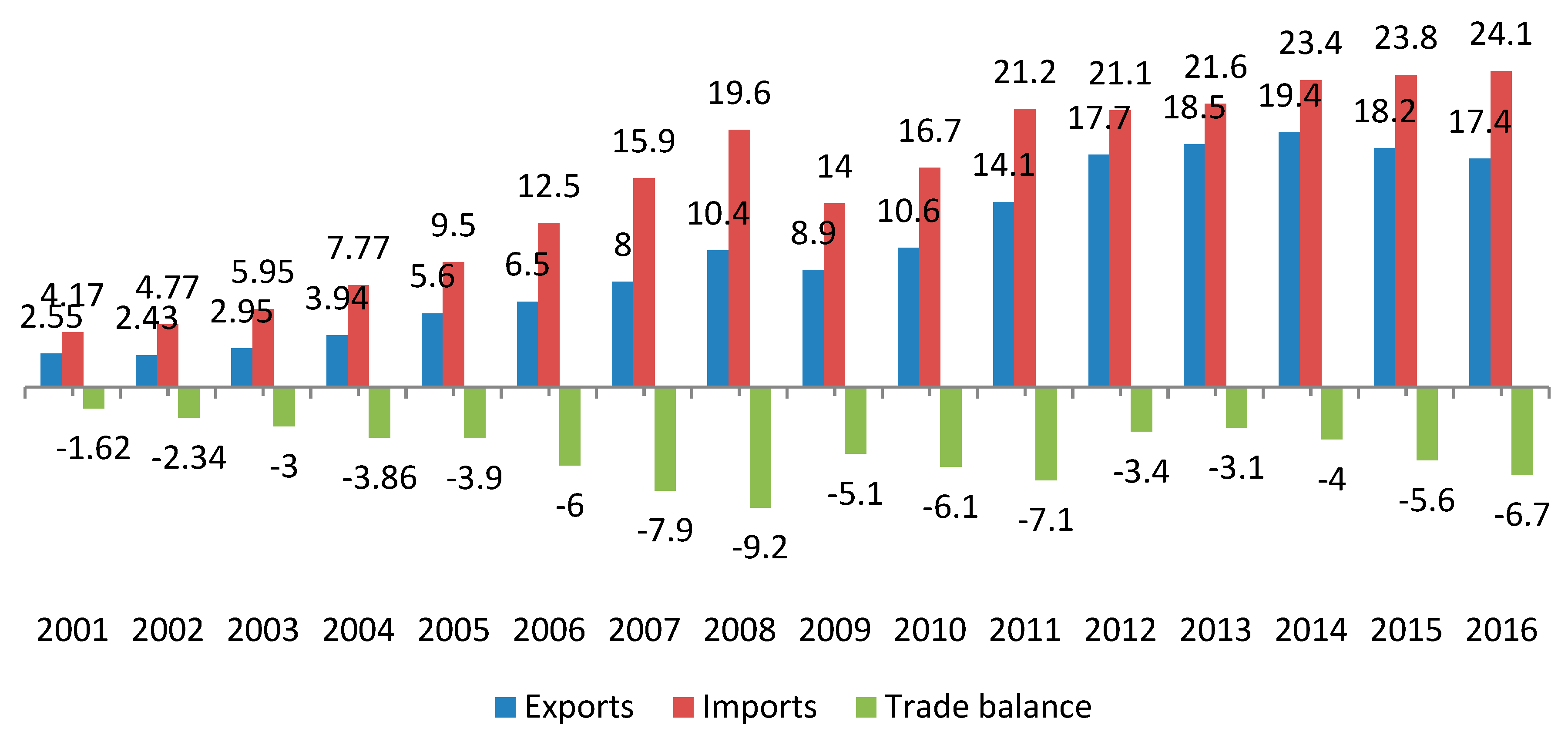

Ii To claim the DTA rate please attach the Certificate of Tax Residence from the. Malaysia and China signed a treaty for the avoidance of double taxation in November 1985. Such transactions are not tax friendly as international exports and imports are a common source of income for countries.

Malaysia has signed a treaty for the avoidance of double taxation with Spain in 2006 and the document became effective starting with 1st of January 2008. EFFECTIVE DOUBLE TAXATION AGREEMENTS. Hereinafter referred to as German tax.

The Agreement shall apply also to any identical or substantially similar taxes that are imposed after the date of signature of the Agreement in addition to or in. The agreement is applicable to the tax residents of both countries who can be natural persons or legal entitiesThe double taxation agreement DTA covers a set of taxes concerning the income of such entities who are tax residents of a contracting state performing. The double tax agreement DTA signed by Malaysia and Spain is applicable to both natural persons and legal entities that obtain taxable income residents of the two contracting states.

Dezan Shira Associates is a specialist foreign direct investment practice providing corporate. The agreement is effective in Malaysia from. I the income tax and ii the petroleum income tax hereinafter referred to as Malaysian tax.

This Agreement shall enter into force on the date of the later of the notifications referred to in. The double tax treaty applies to companies that are residents are incorporated in one or both of the contracting states. Double taxation usually occurs when any individual taxpayer of Malaysia engages in an international business transaction within the territory of another country.

There is no withholding tax on dividends paid by Malaysia companies. Singapore and Malaysia have endeavored to foster a congenial. ARTICLE 1 PERSONAL SCOPE This Agreement shall apply to persons who are residents of one or both of the Contracting States.

The Singapore-Malaysia Double Tax Treaty. Desiring to conclude an Agreement for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income. Ad Browse Discover Thousands of Law Book Titles for Less.

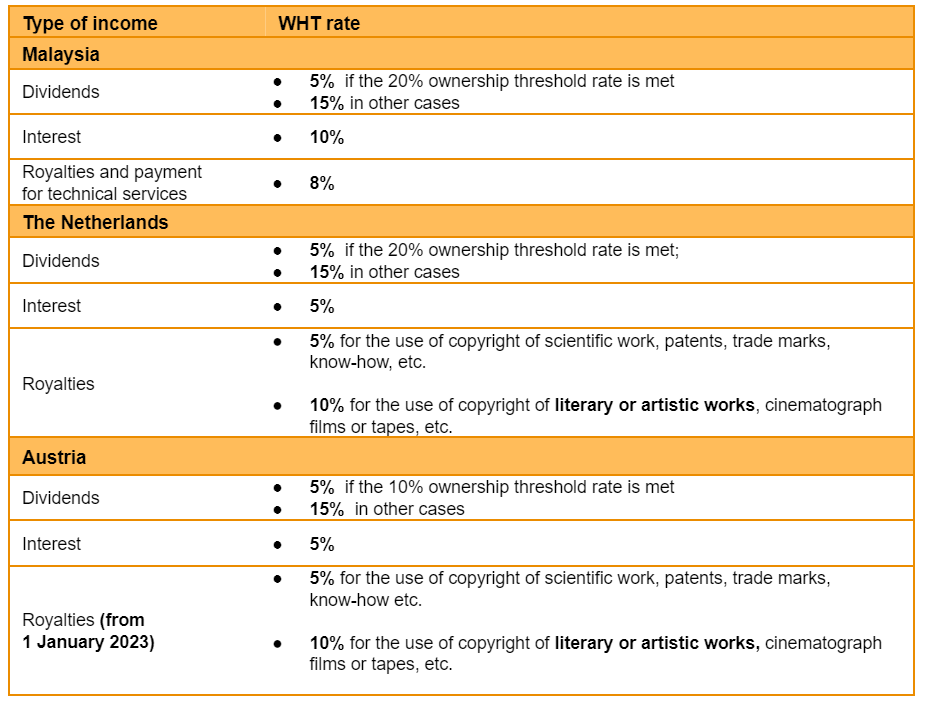

Under the DTA the withholding tax rate for interest is 10 while normally it would be 15 and the withholding tax on royalties is 8 usually it would be 10. ARTICLE 2 TAXES COVERED 1. To benefit from and to implement the reduced withholding rate under the double taxation agreement a taxpayer in Cambodia shall obtain the approval from the General Department.

Double Tax Agreements Withholding Tax Rates. Technical fees are taxed under the treaty at a rate of 5. The Agreement between the Government of the Republic of the Philippines and the Government of Malaysia for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income was signed in Manila on April 27 1982.

Article 1 PERSONAL SCOPE This Agreement shall apply to persons who are residents of one or both of the. Article 1 PERSONAL SCOPE This Agreement shall apply to persons who are residents of one or both of the. The Government of Malaysia and the Government of the Republic of Korea desiring to conclude an Agreement for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income have agreed as follows.

78 rows 2 Malaysia also has a limited double tax treaty covering air transport operations. Â The Contracting Parties shall notify each other in writing of the completion of the procedures required by the respective laws for the entry into force of this Agreement. In order to facilitate the cross-border flow of trade investment financial activities and technical know-how between the two countries the governments of Malaysia and Singapore have signed Avoidance of Double Taxation Agreement DTA.

Jrfm Free Full Text Double Taxation Treaties As A Catalyst For Trade Developments A Comparative Study Of Vietnam S Relations With Asean And Eu Member States Html

Nri Can Use Double Tax Avoidance Agreement Dtaa To Save Tax Nri Saving And Investment Tips Investment Tips Savings And Investment Investing

Pros And Cons Of Public Provident Fund Ppf Account For Tax Saving On India

Is It Mandatory To Declare Foreign Bank Accounts And Assets In Income Tax Return By Nri Nri Saving And Inv Income Tax Savings And Investment Investment Tips

Nre Vs Nro Vs Fcnr Which Savings Or Fixed Deposit Account Nri Should Open

Double Taxation A Tax Case Involving Account 115 In Luxembourg

Countries With Double Taxation Treaties With Pakistan Download Table

Explained Double Taxation Avoidance Agreement Dtaa Youtube

20 Cheques Best Practices For Issuing And Handling Cheques

10 Things Nri Should Know About Portfolio Investment Scheme Pis Nri Saving And Investment Tips Investing Investment Tips Savings And Investment

Double Taxation Agreements In Malaysia Acclime Malaysia

Jrfm Free Full Text Double Taxation Treaties As A Catalyst For Trade Developments A Comparative Study Of Vietnam S Relations With Asean And Eu Member States Html

Double Taxation In Spain What Is It And How Does It Work

What Is Difference Between Nri And Nre Accounts In India

Can You Deposit Indian Rupees To Nre Account

Can I Deposit Inr In Nre Account In India Nri Saving And Investment Tips Investment Tips Savings And Investment Accounting

Double Taxation Treaties In Malaysia Youtube